Among the most difficult undertakings for any business is the reorganization required by a merger or acquisition.

It’s no surprise why.

Each organization has its own culture, workforce structure, technology, and management style. To combine these elements smoothly and effectively is always the goal of HR and business leaders. Of course, ensuring that smooth transition is easier said than done.

So, how can business leaders ensure a smooth M&A?

Twenty percent of corporate executives who responded to Deloitte’s M&A 2020 State of the Deal Report said effective integration is the most important factor in achieving a successful M&A transaction.

A vital piece of the M&A puzzle that contributes to effective integration is understanding and properly implementing comprehensive diversity and inclusion strategies when two organizations are combined.

Ensuring Diversity & Inclusion

Today’s leading businesses understand that a focus on diversity and inclusion is not only a moral imperative, but also a business advantage.

An analysis from McKinsey and Company reports that ethnically diverse companies are 35 percent more likely to financially outperform less diverse companies. According to the report:

“Companies in the top quartile for gender or racial and ethnic diversity are more likely to have financial returns above their national industry medians. Companies in the bottom quartile in these dimensions are statistically less likely to achieve above-average returns. And diversity is probably a competitive differentiator that shifts market share toward more diverse companies over time.”

When it comes to preserving strong diversity and inclusion during an M&A, the biggest challenge HR leaders face is understanding the diversity and inclusion strategies of the organization they are merging with or acquiring. Often, extensive employee data of the target company is hard to come by—whether because of privacy laws or a lack of comprehensive data collection by that organization.

The 3 Steps to Better D&I

If you are an HR or business leader looking ahead to an upcoming M&A, here are three steps that may help preserve strong D&I in your organization:

Make D&I a key part of your M&A from the beginning

According to advisory firm WillisTowers Watson, D&I objectives should be included as part of the targets of an M&A from the get-go. That means asking key questions about the current state of D&I in the organization, assessing whether the company even has a D&I program, and to what extent it agrees with your organization’s approach. “When we acquire a company, we definitely look at what their D&I plans are, how we can integrate them into ours and how we can learn from them, but also how we can make sure that they're meeting our objectives,” Liz Martin, senior M&A HR Manager at Microsoft told WillisTowers Watson.

Develop a comprehensive integration plan

Ensuring diversity and inclusion takes careful planning, especially during an M&A. Human resources leaders should develop comprehensive integration plans that outline the steps each organization will take before, during, and after the reorganization to preserve your D&I philosophy. In a Forbes article titled “Embracing Diversity and Fostering Inclusion Is Good for Your Business,” author Sheree Atcheson says, “Companies need to create environments where people of all races, genders, sexuality, religions, socio-economic backgrounds (and everything in between) can thrive and realistically see themselves as leaders within the industry. To foster this culture, companies need to have a theme of allyship throughout the organization.”

Have a strategy (and the technology) to collect and understand key D&I data

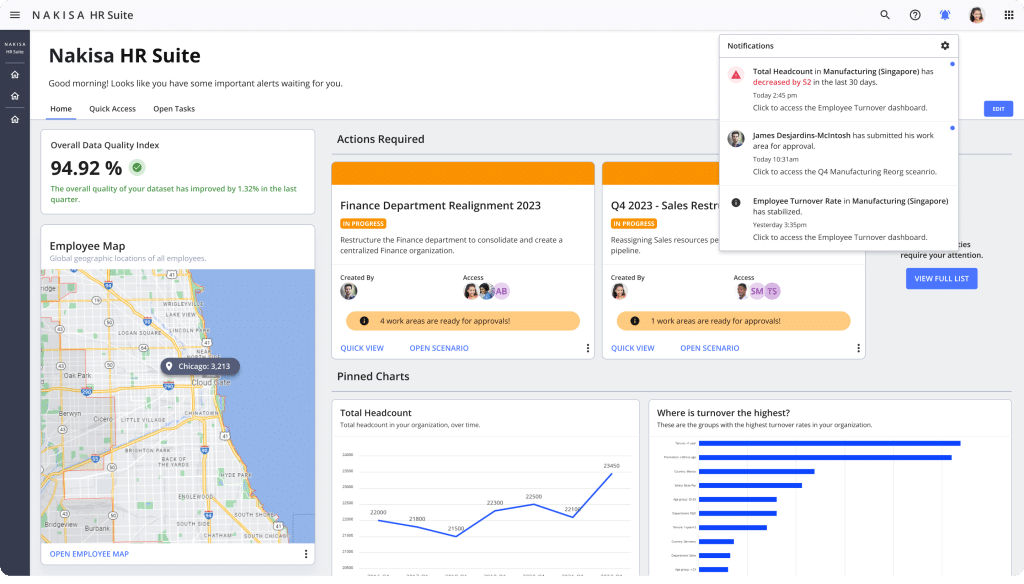

While accessing and collecting data from your target organization is often difficult due to privacy laws and company disclosure policies, understanding that data is vital to making key integration decisions. Once they’ve obtained that data, the next big challenge for HR leaders is interpreting an organization’s current state of D&I and in order to determine what the new balance of diversity and inclusion would look like after the M&A. To help with this effort, many organizations are turning to comprehensive organizational transformation tools that can organize key data, visually map that data, and allow HR leaders to test different scenarios to ensure the new org design meets D&I standards.

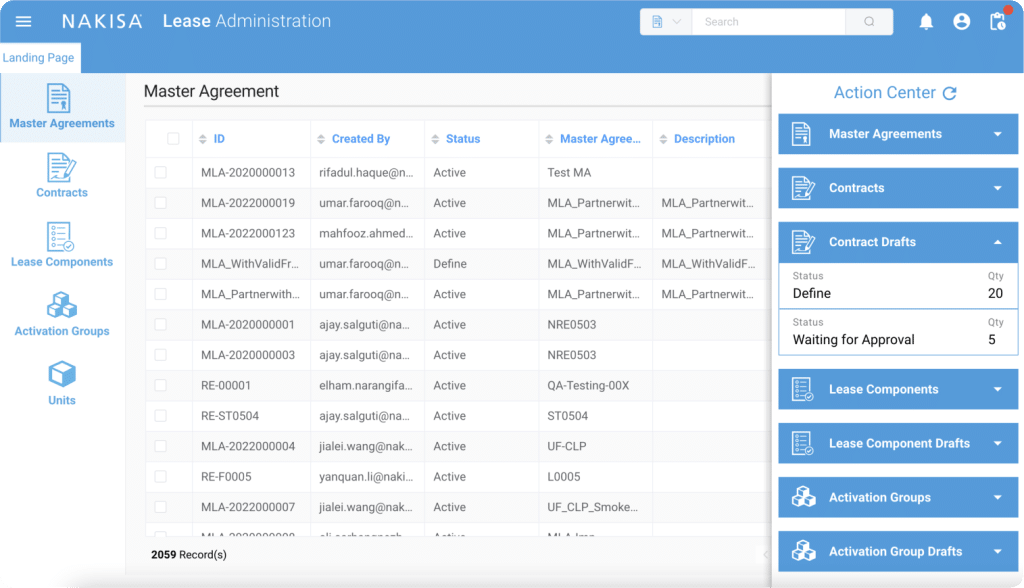

Nakisa HR Suite (formerly Hanelly), for instance, provides advanced, out-of-the-box analytics to understand global diversity metrics. The solution also provides dashboards for understanding key D&I metrics (like age distribution) to help develop succession and diversity plans. It also allows business leaders to develop D&I filters to focus on potential problem areas. Most importantly, Nakisa HR Suite’s M&A features allow leaders to model and visualize data across multiple organizational structures all within one tool—ensuring smooth, comprehensive M&A planning. Learn more about Nakisa HR Suite here or book a demo to see it firsthand.