Bruce Conway | Senior Advisor - Solution Engineering @ Nakisa

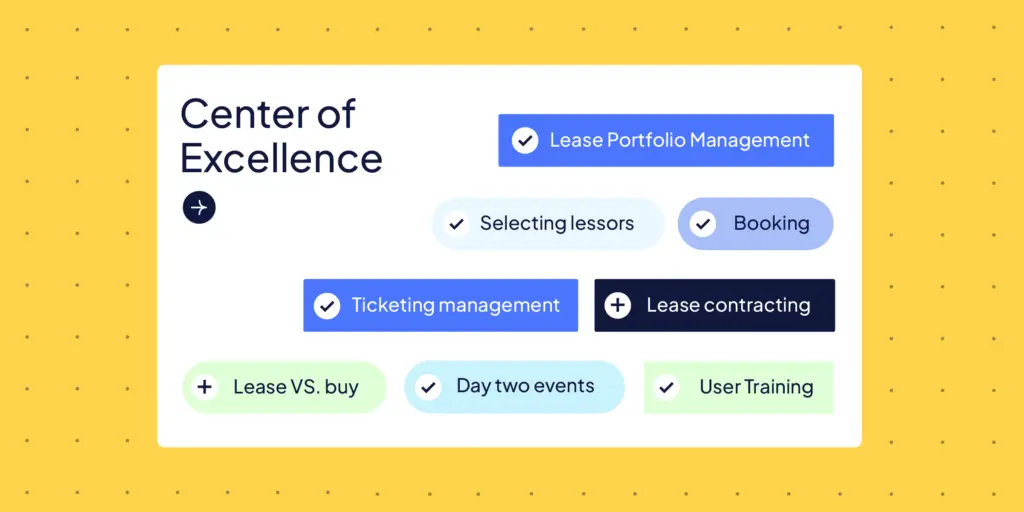

In the first blog in this series, which is based on this webinar I gave recently, we presented the main idea behind a leasing Center of Excellence (CoE), how you could build it in your organization, and whether outsourcing it was your best option. In this second article, we’ll discuss in more detail which processes are typically internal or external to the CoE in lease accounting and lease management. We’ll explore the interaction between the CoE and the various departments, which traditionally heavily relied on personal engagement but is now moving towards a greater focus on system integration, data management, analysis, and ensuring data completeness and accuracy.

For better navigation in this blog post, I divided the leasing processes into two types: before and after lease closing, and shared my experience on where each function typically resides. Still, your final decision should be guided by your unique circumstances. You need to assess the size and complexity of your leasing portfolio as well as your company’s workforce and their skill sets to see where each process logically fits.

What is the CoE involvement before lease closing?

Selection of lessors: CoE, Procurement, and Finance collaboration

The Center of Excellence’s involvement with lessor selection will depend on your organization’s size: the larger the company, the bigger the involvement. Typically, the CoE is involved in the selection process, but they don’t play a leadership role. Often, it’s part of the responsibilities of the Treasury, working with the Procurement or maybe Finance.

However, you shouldn’t overlook the CoE when selecting lessors. Sometimes, only the CoE truly understands the service levels (or lack thereof) that the lessors have provided on their previous financings. This understanding is crucial not just from a financial or administrative perspective but also in terms of visibility. Sometimes, you don’t have the necessary data to make informed decisions and understand what your lessors are truly earning.

Also, the CoE members understand specific Terms & Conditions—like restrictive end-of-term conditions and excessive purchase option prices—better than other departments because they’re involved in those transactions daily with Lessors, which is different from the Treasury or Procurement.

In very large organizations, it’s not uncommon that the primary person responsible for selecting the lessor is within the CoE. However, this individual heavily relies on the expertise of professionals in the Treasury, Procurement, and Finance.

The role of the Center of Excellence in lease versus buy decision

When it comes to CoEs and lease vs. buy, there's no actual common ground and from my experience, I see the greatest level of variability in this aspect. In some cases, the Center of Excellence doesn’t get involved until the lease contract is fully executed, while in others, it’s involved from the beginning. After all, numerous variables exist in a lease vs. buy analysis, such as when the type and duration of the lease required is determined by Procurement, the weighted average cost of capital rates comes from Treasury, the tax depreciation rates for tax savings purposes in your cash flows comes from your tax department, and many more.

That doesn’t mean that a CoE member should be a procurement, finance, or tax expert to deal with a lease vs. buy analysis, but they do require certain expertise and an understanding of the lease vs. buy process to coordinate it. Here are some aspects that CoE members should consider:

- Relevant data - They need to understand the data that goes into a lease vs. buy analysis and where to get the data from, mainly because the individual procuring the asset in the business units typically doesn’t have that information.

- Technology - They must know the systems and integrations needed to push for automation in those areas. This is key if you're talking, for example, about creating an Excel file with IBR rates, tax rates, and useful lives for tax depreciation purposes or assisting in creating APIs into the Treasury or Tax Management systems.

- Overall lease vs. buy process - They must understand when a lease vs. buy is necessary. For example, if a company has a policy to lease all vehicles, the CoE should accept lease documentation for vehicles without a lease vs. buy. But if that asset category requires a lease vs. buy for every lease, it must be in the documentation requirements. Then, the CoE will create and enforce the policy with other departments.

Another crucial aspect of lease vs. buy is consistency. Sometimes, you’ll see multiple versions of a lease vs. buy with different assumptions built into them and plenty of inconsistencies. If you see that happen, it’s a sign that you should have a CoE create and enforce a single model across the organization and be responsible for the updates.

Pro Tip

Your CoE needs to understand additional systems that are not part of the core leasing subledger or ERP, so users can access the data they need. Those systems can be:

- Real Estate (part of IWMS)

- Accounts Payable

- Fixed (Purchased) Assets

- Fleet Management

- IT Asset Management Systems (ITAMs)

- Contract Management & Origination

- Deferred Income Tax - Lease

- Lease vs. buy

- Others

Lease contracting within the leasing Center of Excellence

Similar to lease vs. buy, the CoE’s involvement with lease contracts varies greatly. In terms of real estate, CoEs don’t typically do much since large organizations have real estate teams that handle pretty much everything themselves. It's different with equipment, though: if equipment leases are created throughout the organization, in various countries and divisions, it’s ideal to centralize this process with a small team dealing with lessors to get economies of scale.

The Center of Excellence will also probably coordinate the documentation, ensuring everything’s complete and consistent and signing off on lease contracts (or, at least, being one of the individuals requiring sign-off). This is a crucial aspect of the process. When the new lease accounting standards started, many companies centralized their lease documents within a CoE to ensure they had one repository. They don’t enter the contract details in their leasing system until it’s completed—in other words, if the documentation details are not in the subledger, it doesn’t exist within the CoE either, and then the lessor doesn’t get paid.

Pro Tip

Ensure your CoE establishes a central repository of your standard types of lease contracts in import files. You can use the library to onboard or train new team members or validate new software releases.

The CoE's role in lease close procedures and portfolio management

These areas—related to lease administration and financial reporting—are where companies have more common ground. Having a centralized CoE is the best solution here.

How does the Center of Excellence optimize booking and lease portfolio management?

Why would booking and all lease portfolio management be typically within the CoE? Given the vast amount of data required within your sub-ledger, it takes a lot of skill, focus, and knowledge of the sub-ledger and the data to produce accurate financial reporting for compliance purposes and operational decision-making. Decentralized divisions won’t have that level of expertise.

That's not to say that the only people using the sub-ledger are in the CoE. Lease administrators are usually the ones who better know the system and the required data, and other stakeholders may be involved in reviewing, approving, or uploading certain information such as IBR and FX rates. However, it’s the CoE who enters the master lease agreements, contracts, and the asset-level data associated with the contract. They have the most efficient, automated ways to get the data into their sub-ledger and perform reconciliations between contracts and contract data or between the sub-ledger and the general ledger (GL).

If that’s not your situation, ask yourself why it's not. Could it be better handled through a CoE? Even if you don’t control the GL or the ERP, you can control what goes into it and determine which accounts are locked, so you can own the reconciliation between subledger and GL. I’ve seen that allocated to business units with CoE support, but it would be less efficient.

Day two events: The CoE as the best option to streamline changes, modifications, returns, and buyouts

Everything we’ve discussed for booking deals also applies to day two events, such as changes, modifications, returns, and buyouts. Those events can become rather complex, so it’s best to have the CoE manage this process with a sub-ledger and automated solutions. If you’re interested in exploring this subject further, don’t hesitate to contact me. I’d be more than happy to help.

The CoE's involvement in user training and ticket management

Another role of the CoE is to serve as a support center for users across the organization who might be using the system for specific tasks. For example, the CoE would be responsible for creating new users in the system and revoking access, all following the company’s policies. There could also be a ticketing system where infrequent system users submit tickets that expert users in the CoE will respond to. I see this scenario frequently, and if it has something to do with the system itself, the expert users in the CoE will submit tickets to the actual software vendor.

You may find interesting our webinar and textual guide on how to master lease accounting and audit for IFRS 16 and ASC 842 in the digital age. In the guide, our expert Franco Massaro shares the best practices and winning strategies.

How will AI transform the leasing Center of Excellence?

Today, most CoEs are focused on pure accounting compliance and ensuring data completeness and accuracy in the systems. This is a huge effort in and of itself, but with recent advancements in lease accounting sub-ledgers and generative AI tools, this landscape will probably change.

With daily business processes incorporating large language models (LLM) via tools like Microsoft Copilot, we can expect significant improvements in the communication between departments and stakeholders across the organization—one of the main roles of a CoE. Not only that, microservice architectures and APIs can also take advantage of those new technologies and transform lease management software for enterprises.

As for people’s roles, it’s plausible that some administrative tasks will disappear, but it doesn’t mean the end of the Center of Excellence. More likely, the people in the CoE will stop doing month-end reconciliations, analyzing anomalies or fluctuations, and resolving discrepancies to focus on how to help the organization save money by realizing the economic benefits of leasing.

For example, they can identify excessive evergreen or month-to-month spending for a specific department or user, assist in creating bots that can negotiate with lessors more effectively, or better understand their return rate when negotiating a buyout or an extension. This is the way the CoE of the AI era will help bring even more value to the table than today.

Finally, I want to discuss Nakisa’s lease accounting software (NLA). It addresses many of the issues discussed in this and the previous blog, with microservice-based, cloud-native features that can help enterprises achieve full compliance and unprecedented efficiency. Just click here to learn more, or if you prefer, book a demo.