Lease management software for global enterprises

Enterprise-grade solution trusted by industry leaders

Total number of active leases

Total value of leases (ROU)

Efficiency gains after deployment

Nakisa's lease management software becomes an extension of your teams

Contract Administrator

Contract Administrator

Capital Projects Manager

Capital Projects Manager

Accountant

Accountant

Executive

Executive

What our clients say about Nakisa

We are using Nakisa for real estate for all of our markets. The benefit that we have seen is that it can do the accounting IFRS 16, ASC 842 and have SAP integration.

Nakisa allowed us to close our books a week before month-end. Now anyone can easily run a report the last week of the month to verify depreciation, cost centers, and other aspects and ensure they are all correct. We are starting to use the automation of contract uploads and mass lease modifications, and they are going to be a huge win for us. I think we will get a lot of productivity gains out of those features.

Nakisa offers excellent software allowing us to be more efficient with all our rent payments and to do better follow-ups on our deadlines, renewals, deposits, etc. The software allows us to create custom made reports to be used with our financial statements. These reports are also good tools to communicate information to various divisions in order to help them with their budgeting. The software is very user-friendly. In short, it is essential for our real estate department.

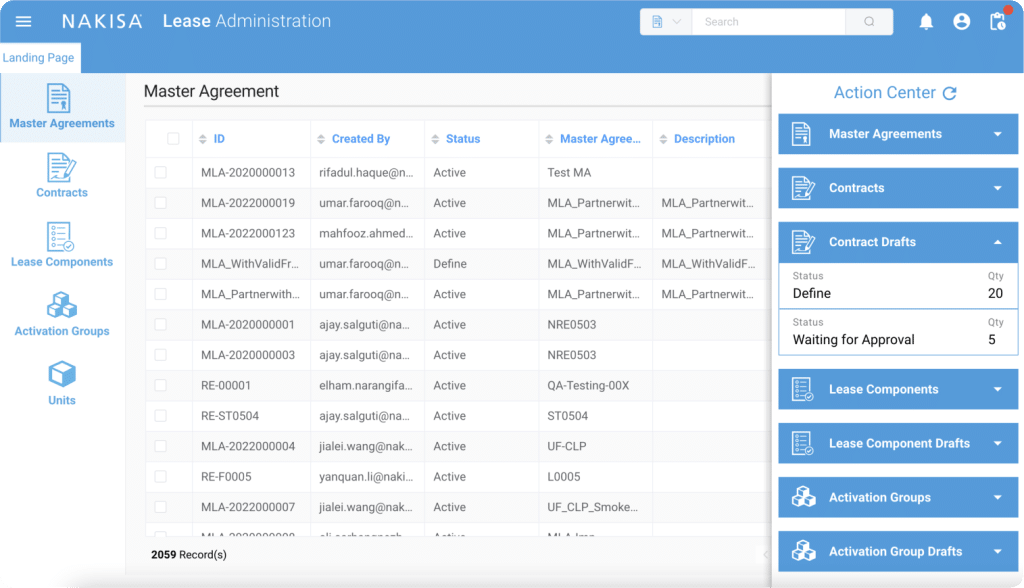

Lease management system that supports your portfolio growth

Automate contract administration to boost operational efficiency

Easily extract and summarize data from contracts, invoices, and other documents with Nakisa AI Document Abstraction. Upload single or multiple files and get key data points, fully traceable to their source for accuracy and compliance. After validation, export the data to Excel or integrate it directly into Nakisa Lease Management for mass contract creation.

Utilize Nakisa’s virtual library to centralize, tag, and view all documents associated with specific leases in one place. Host all contacts and link them to respective vendors. Track and report on assets throughout their lifecycle. Manage obligations, handle renewals, amendments, and terminations. Enjoy easy navigation and retrieval within the app.

Get notifications and email reminders for upcoming dates, per lease, clause, or condition. Stay on top of your activities, pending activations, and deadlines. Save time and avoid paying for delays!

Have your vendors upload invoices to the vendor portal, for easier auditing, automated calculations, and smoother reconciliation. Allocate costs among multiple vendors using our rent table and streamline invoice management with the vendor portal.

AI Document Abstraction

Easily extract and summarize data from contracts, invoices, and other documents with Nakisa AI Document Abstraction. Upload single or multiple files and get key data points, fully traceable to their source for accuracy and compliance. After validation, export the data to Excel or integrate it directly into Nakisa Lease Management for mass contract creation.

Document and contact management

Utilize Nakisa’s virtual library to centralize, tag, and view all documents associated with specific leases in one place. Host all contacts and link them to respective vendors. Track and report on assets throughout their lifecycle. Manage obligations, handle renewals, amendments, and terminations. Enjoy easy navigation and retrieval within the app.

Critical dates management

Get notifications and email reminders for upcoming dates, per lease, clause, or condition. Stay on top of your activities, pending activations, and deadlines. Save time and avoid paying for delays!

Vendor portal

Have your vendors upload invoices to the vendor portal, for easier auditing, automated calculations, and smoother reconciliation. Allocate costs among multiple vendors using our rent table and streamline invoice management with the vendor portal.

Benefit from accurate multi-factor calculations to eliminate errors and avoid overcharges

Automate complex rent calculations, such as scenario-specific fixed and variable payments, non-standard calendars, multi-currency, and multi-vendor.

Automatically reconcile the accrual of expenses against total operating costs to identify differentials and avoid overcharges.

Automatically host multiple CPIs and apply them to payments to calculate adjustments. No manual maneuver needed.

Automatically allocate costs among multiple vendors, and have the payments seamlessly integrated within your ERP system without manual intervention. Manage payments through a pervasive rent table and view any step-ups and other changes.

Use batch payments to schedule, post, or reverse multiple payments and charges for several contracts at the same time.

Rent calculation

Automate complex rent calculations, such as scenario-specific fixed and variable payments, non-standard calendars, multi-currency, and multi-vendor.

Percentage or sales-based rent

Easily manage complex percentage rent calculations with Nakisa. Simply prompt our AI agent to create custom formulas for variable rent calculations. You can set multiple percentage rent scenarios and exclude specific categories as needed.

Reconciliation (CAM, tax, insurance)

Automatically reconcile the accrual of expenses against total operating costs to identify differentials and avoid overcharges.

CPI indexation

Automatically host multiple CPIs and apply them to payments to calculate adjustments. No manual maneuver needed.

AP/AR management

Automatically allocate costs among multiple vendors, and have the payments seamlessly integrated within your ERP system without manual intervention. Manage payments through a pervasive rent table and view any step-ups and other changes. Use batch payments to schedule, post, or reverse multiple payments and charges for several contracts at the same time.

Use advanced analytics and reporting for timely insights and proactive business decisions

Easily visualize your entire portfolio and drill down to critical information. Use out-of-the-box reports on critical dates, CPI indexation, financial obligation, CAM reconciliation, and percentage rent among others. Create ad-hoc, permission-based dashboards by prompting our AI agent for analytics.

Set up a budget for a specific period. Easily manage budgets and forecast needs based on occupancy rates and growth projections.

Compare up to 10 existing and potential sites side-by-side, and evaluate various KPIs such as forecasted expenses and returns, capital investment and incentives, base rent, CAM, and more. Select the best fit for your portfolio during expansion, relocation, or renewal.

Analytics and reporting

Easily visualize your entire portfolio and drill down to critical information. Use out-of-the-box reports on critical dates, CPI indexation, financial obligation, CAM reconciliation, and percentage rent among others. Create ad-hoc, permission-based dashboards by prompting our AI agent for analytics.

Budgeting and forecasting

Set up a budget for a specific period. Easily manage budgets and forecast needs based on occupancy rates and growth projections.

Site selection

Compare up to 10 existing and potential sites side-by-side, and evaluate various KPIs such as forecasted expenses and returns, capital investment and incentives, base rent, CAM, and more. Select the best fit for your portfolio during expansion, relocation, or renewal.

Let's have a no-obligation call!

There, we'll discuss how Nakisa's lease management software can transform and streamline your lease administration and lease accounting.

Lease management software compliant with IFRS 16, ASC 842, and local GAAP lease accounting

Utilize mass data uploads through bilateral ERP sync, APIs, or flat files. Our software facilitates seamless mass import of lease agreements from diverse sources, such as spreadsheets and legacy solutions. Use the Nakisa AI Agent for document abstraction to streamline the extraction, validation, and processing of critical lease accounting data from a variety of documents, including lease agreements, amendments, invoices, and more. Built for scale and precision, it reduces manual effort while maintaining full auditability and control, ensuring key fields are accurately captured and validated during migration.

Leverage comprehensive lease accounting and administration capabilities across the lease lifecycle, from inception to modifications, renewals, and purchases. Unlike other vendors, we provide true contract- and asset-level accounting capabilities. Our mass operations feature streamlines bulk processes such as modifications, indexations, or workflow transitions.

With AI-powered capabilities, automate the creation and management of terms, conditions, and charges; track critical dates, payment schedules, and lease clauses with proactive notifications; and gain real-time insights into portfolio performance through customizable reporting and analytics tools. Automate complex calculations for right-of-use assets, lease liabilities, and interest expenses, and ensure compliance with disclosure reporting under multiple standards.

Utilize scheduled or on-demand posting from Nakisa’s subledger to your ERP GL for seamless financial data synchronization and automated payment processing, with posting start dates defined per accounting standard. Preview journal entries before posting to assess their impact.

Our software manages complex payment scenarios, including variable rent, percentage-based rent, CPI indexations, multi-vendors, and multi-currency, and supports various payment schedules—from simple monthly payments to non-standard structures—while maintaining a clear audit trail for compliance and tracking purposes. Efficient batch payment processing handles multiple transactions simultaneously, saving time and reducing errors.

Automate compliance with ASC 842, IFRS 16, and local GAAP standards while easily generating comprehensive disclosure reports. Our software features highly configurable dashboards for financial transparency and offers extensive flexibility, including non-standard 4-4-5 calendars, automated indexation adjustments, multi-currency FX translation under ASC 830 and IAS 21, and modification and reassessment recordings on any effective date.

Ensure complete financial control and accurate period-end closings with automated period-end balance calculations, ledger enrichment mapping for seamless data consistency, and secure general journal entry workflows for controlled GL adjustments.

Lease data capture

Utilize mass data uploads through bilateral ERP sync, APIs, or flat files. Our software facilitates seamless mass import of lease agreements from diverse sources, such as spreadsheets and legacy solutions. Use the Nakisa AI Agent for document abstraction to streamline the extraction, validation, and processing of critical lease accounting data from a variety of documents, including lease agreements, amendments, invoices, and more. Built for scale and precision, it reduces manual effort while maintaining full auditability and control, ensuring key fields are accurately captured and validated during migration.

Lease accounting and administration

Leverage comprehensive lease accounting and administration capabilities across the lease lifecycle, from inception to modifications, renewals, and purchases. Unlike other vendors, we provide true contract- and asset-level accounting capabilities. Our mass operations feature streamlines bulk processes such as modifications, indexations, or workflow transitions.

With AI-powered capabilities, automate the creation and management of terms, conditions, and charges; track critical dates, payment schedules, and lease clauses with proactive notifications; and gain real-time insights into portfolio performance through customizable reporting and analytics tools. Automate complex calculations for right-of-use assets, lease liabilities, and interest expenses, and ensure compliance with disclosure reporting under multiple standards.

Transaction posting and payment

Utilize scheduled or on-demand posting from Nakisa’s subledger to your ERP GL for seamless financial data synchronization and automated payment processing, with posting start dates defined per accounting standard. Preview journal entries before posting to assess their impact.

Our software manages complex payment scenarios, including variable rent, percentage-based rent, CPI indexations, multi-vendors, and multi-currency, and supports various payment schedules—from simple monthly payments to non-standard structures—while maintaining a clear audit trail for compliance and tracking purposes. Efficient batch payment processing handles multiple transactions simultaneously, saving time and reducing errors.

Compliance

Automate compliance with ASC 842, IFRS 16, and local GAAP standards while easily generating comprehensive disclosure reports. Our software features highly configurable dashboards for financial transparency and offers extensive flexibility, including non-standard 4-4-5 calendars, automated indexation adjustments, multi-currency FX translation under ASC 830 and IAS 21, and modification and reassessment recordings on any effective date.

Ensure complete financial control and accurate period-end closings with automated period-end balance calculations, ledger enrichment mapping for seamless data consistency, and secure general journal entry workflows for controlled GL adjustments.

Auditing and reporting

Nakisa generates audit-ready reports with drill-down capabilities, ensuring compliance with IFRS 16, ASC 842, and local GAAP. The platform supports complex calculations, such as right-of-use (ROU) assets and lease liabilities, while offering standard and customizable reports. Nakisa offers comprehensive financial reports such as Income Statement, Balance Sheet, and Cash Flow, and detailed disclosure reports, including Asset Roll Forward, Lease Liability, Weighted Average Lease Term, Weighted Average Discount Rate, and Maturity Analysis, which support regulatory filings like 10-K and 10-Q. Nakisa also provides transactional and management reports, such as Consolidated Financial Schedules, Periodic Posting Status, Contract Expiration, and Data Quality and Integrity (DQI). Multi-dimensional reporting across lease types, locations, and variables is configurable at the company or user level, with robust scenario analysis and forecasting capabilities.

What our clients say about Nakisa

I can see that end users do more value-added jobs now. They don’t need to chase the real estate team for lease information or perform manual data entry. Instead, they validate data and close efficiently. For example, month-end closing is now twice as fast with Nakisa, saving 50% of man-hours.

Now the team can update contracts much faster and save a lot of time while working on monthly, quarterly, and annual financial reports. If before Nakisa some countries needed to spend 6-7 working days to identify financial impacts, now it only takes 1 day or, during a particularly eventful month, 2 days. This is a significant win for us. This efficiency benefits both the company and end users, ensuring accurate and timely presentation of financial statements.

Nakisa has a lot to offer in terms of flexibility, user-friendliness, ERP Integration and its cloud solution. The integration is really important, because once we have verified that contracts are captured correctly in the Nakisa system, we don’t want to worry if in the ERP the data are also correct and to run complex reconciliations every month.

Comprehensive lease management capabilities for your industry

Retail and Restaurants

Retail businesses rely on efficient lease management and accounting to navigate complex lease agreements for stores, warehouses, and office spaces. Our retail lease management software streamlines lease tracking, rent payments, and expense management such as percentage rent and CAM, while ensuring compliance with lease terms and accounting standards (local GAAP, IFRS 16, ASC 842). With features tailored to retail needs, such as store selection, critical date alerts, and automated calculations, our commercial lease management software empowers retailers to optimize occupancy costs, make informed decisions, and drive profitability.

Pharmaceutical

Pharmaceutical companies manage a wide array of leases, including research labs, manufacturing facilities, offices, and specialized equipment. Our pharmaceutical lease management software simplifies lease administration, ensuring compliance with pharmaceutical industry regulations and accounting standards. Equipped with features like lease abstraction, critical date tracking, and compliance reporting, our software empowers companies to efficiently manage their portfolios, mitigate risks, and enhance operational efficiency. Ultimately, this supports their mission of delivering life-saving medications to patients worldwide.

Transportation

Among the various assets managed by transportation companies are fleets of vehicles, terminals, and logistics hubs. With features such as lease tracking for facilities, maintenance scheduling, real-time insights into lease data, and automated tasks, Nakisa software empowers transportation companies to make strategic decisions, improve operational efficiency, and drive profitability. Our lease accounting solution ensures operational excellence and addresses the complexity of managing geographically diverse assets and their impairments under various accounting standards (local GAAP, IFRS 16, ASC 842).

Manufacturing

Our manufacturing lease management software offers essential features such as lease tracking for facilities, maintenance scheduling, and real-time insights into lease data. This empowers manufacturing companies to efficiently manage their diverse range of leased assets, including production facilities, equipment, and warehouses, reducing operational risks and optimizing costs. Nakisa software streamlines the accounting for PP&E lease portfolios, handling large lease portfolios, embedded leases, and international operations with ease. This facilitates the accounting cycle, ensuring compliance and efficiency in the financial reporting process.

Telecom

Telecommunication companies manage a diverse portfolio of leased assets, including cell towers, data centers, office spaces, and equipment. Our telecom lease management software provides crucial features designed to streamline property lease administration, including lease activity tracking, critical date and clause reminders, payment management, real-time insights into lease data, site selection, and more. Additionally, it simplifies accounting processes and reporting for real estate, land, and equipment leases, ensuring compliance with local GAAP and international lease accounting standards for telecommunication companies.

Financial Services

Financial services firms oversee diverse portfolios of leased assets, including office spaces, equipment, and vehicles. Our corporate lease management software offers essential features to streamline property lease administration, such as lease activity tracking, critical date reminders, payment processes management, automated reconciliation, site selection, and advanced analytics. With intuitive handling of large lease portfolios and ensuring compliance with IFRS 16, ASC 842, and local GAAP accounting standards, our solution simplifies lease accounting and compliance for financial services firms across the lease lifecycle stages.

Healthcare

Healthcare practices demand a unique set of commercial leases tailored to their industry-specific needs and regulatory standards. Our healthcare lease management software is designed to address the intricacies of medical use leases. Equipped to handle both finance and operating leases, it streamlines the accounting process, particularly for medical equipment classified as operating leases under the IFRS 16 and ASC 842 standards. With the Nakisa platform's mass lease tool, healthcare practices managing a high volume of leases can efficiently manage their lease portfolio.

Public sector

With the adoption of IFRS 16 and ASC 842, lease accounting has become increasingly challenging for the public sector. Nakisa's lease management solution addresses these complexities by providing tailored solutions for public sector entities. It efficiently handles the diverse range of leases within the public sector, including land, PP&E, and fleet management, catering to both government bodies and smaller-sized public entities. Our software streamlines accounting processes through automated asset depreciation calculations, mass modification functionalities, and support for short-term and low-value leases.

What sets Nakisa apart?

Built for large, complex enterprise portfolios

Nakisa easily handles complex scenarios like large contract volumes, high monthly activities, irregular calendars, multiple ERPs, standards, currencies, languages, modifications, and events. Our solutions grow with your success. We design and build all our upgrades based on what our clients want and what we know they'll need.

Native ERP integration and robust APIs

Connect isolated data sources, ERPs, and various SaaS tools with the open platform to build one source of truth. Use native bidirectional ERP integrations (SAP S4/HANA, SAP ECC, Oracle, Workday) and robust APIs to streamline, validate, and write back data. Ensure data integrity with our technologies.

Learn more about Nakisa's integrations

Parallel compliance with IFRS 16, ASC 842, local GAAP

Fortune 1000 companies have successfully used Nakisa for reporting and disclosures since the inception of the new accounting standards. With Nakisa, manage all your leases under these standards simultaneously on one unified platform. Our lease accounting system accommodates each standard’s unique requirements and allows you to generate disclosure reports accordingly.

Learn more about Nakisa's compliance

Automation and AI-driven innovation

Unlike other vendors, Nakisa is built on an innovative cloud-native platform, leveraging microservice-based architecture. This robust technology provides clients with the flexibility, resilience, and speed they need to thrive in today’s digital landscape.

Integrated with state-of-the-art generative and agentic AI and leveraging Retrieval-Augmented Generation (RAG), Nakisa automates daily tasks, reduces manual workloads, and boosts productivity.

Learn more about Nakisa's technology

Explore Nakisa's AI capabilities

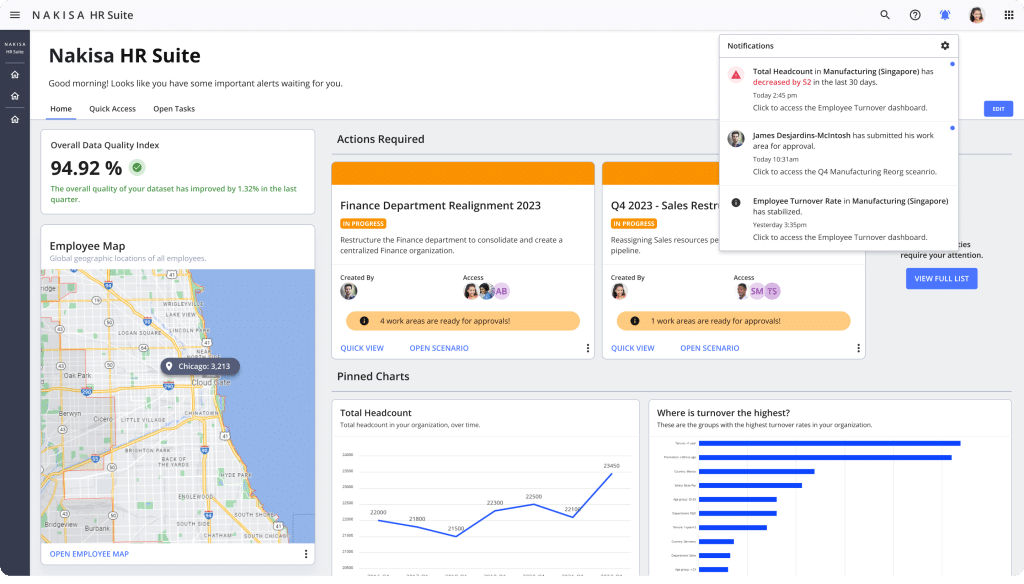

Team-specific UIs, single asset repository

Various teams can leverage purpose-built interfaces and tailored features to meet their specific goals, all while working from a unified data repository. With seamless cross-product data integration and analytics, teams gain a holistic view and can make data-driven decisions with confidence. Granular role-based access controls and robust segregation of duties ensure secure collaboration, data integrity, and compliance.

Cyber security and data privacy

Nakisa is built on a secure platform with data encryption, role-based access control, Single-Sign-On, and audit capabilities to ensure compliance requirements with provide SOC 1 Type II & SOC 2 Type II, ISO 27001, ISO 27017 FIPS 140-2, GDPR, and IT General Control (ITGC). Learn more about Nakisa's security

What sets Nakisa apart?

Built for large, complex enterprise portfolios

Native ERP integration and robust APIs

Connect isolated data sources, ERPs, and various SaaS tools with the open platform to build one source of truth. Use native bidirectional ERP integrations (SAP S4/HANA, SAP ECC, Oracle, Workday) and robust APIs to streamline, validate, and write back data. Ensure data integrity with our technologies.

Parallel compliance with IFRS 16, ASC 842, local GAAP

Fortune 1000 companies have successfully used Nakisa for reporting and disclosures since the inception of the new accounting standards. With Nakisa, manage all your leases under these standards simultaneously on one unified platform. Our lease accounting system accommodates each standard’s unique requirements and allows you to generate disclosure reports accordingly.

Automation and AI-driven innovation

Team-specific UIs, single asset repository

Cyber security and data privacy

Nakisa is built on a secure platform with data encryption, role-based access control, Single-Sign-On, and audit capabilities to ensure compliance requirements with provide SOC 1 Type II & SOC 2 Type II, ISO 27001, ISO 27017 FIPS 140-2, GDPR, and IT General Control (ITGC).

Ready to take your lease management to the next level?

Explore how Nakisa’s lease management system can streamline lease administration and lease accounting for your global company.

GET FREE DEMO

Explore how Nakisa can benefit your business firsthand

Frequently Asked Questions

What is lease management software?

Lease management software helps organizations efficiently manage and automate the entire lifecycle of their lease agreements, whether for real estate properties, equipment, vehicles, or other assets. It provides a centralized platform to store and organize lease data, track critical dates and payments, automate lease accounting processes, generate compliance and accounting reports, and streamline processes like lease renewals and modifications. By consolidating lease portfolios, accounting, and operational activities into one system, providing automated workflows and robust analytics capabilities, and sending alerts for key lease milestones, lease management software enhances visibility, accuracy, and control over leased assets, reduces costs, and supports better decision-making, while ensuring adherence to accounting standards like ASC 842 and IFRS 16.

What types of leases does Nakisa's lease management software support (real estate, equipment, etc.)? Can it handle complex lease scenarios like renewals and modifications?

Nakisa software supports any fixed asset lease, including real estate, equipment, land, and fleet. Built for global enterprises, it simplifies lifecycle lease management for large, complex leased and sub-leased assets. It can handle multiple modifications and events, diverse deal structures, subleasing options, various ERPs, accounting standards, currencies, languages, irregular calendars, and more.

How does Nakisa's lease management software ensure compliance with accounting standards like ASC 842, IFRS 16, etc.? What reporting capabilities does it offer?

Nakisa Lease Management software ensures parallel compliance with IFRS 16, ASC 842, and local GAAP standards. It provides true contract and asset-level accounting and lease tracking. The solution also offers easily auditable, highly configurable reports with drill-down capabilities, ensuring comprehensive and accurate reporting.

What lease management processes does Nakisa software automate (payment tracking, critical date monitoring, reporting, etc.)?

Nakisa lease management software is your single solution to automate enterprise lease administration and lease accounting. It streamlines lease data capture, document and contact management, critical date monitoring and reporting, vendor management, payment administration, lease accounting and compliance, transaction posting and payment processes, lease auditing and reporting, and more.

Can Nakisa's lease management software integrate with existing systems like ERPs, accounting software, financial systems, etc.? What integration options are available?

Nakisa lease management system provides native bidirectional

ERP integrations with SAP ECC and SAP S4/HANA, as well as Oracle. Additionally, it offers APIs with third-party SaaS tools like Blackline, and supports flat file integrations.

How scalable is the Nakisa solution as our lease portfolio grows? Can it accommodate a high volume of leases and users?

Nakisa's enterprise-grade software is built on a microservices architecture, ensuring scalability to handle high volumes of leases, events, and modifications as your portfolio grows. With Nakisa, get robust features to easily manage 100,000+ lease contracts from A to Z.

What is Nakisa's implementation process like? How much training and support is provided during onboarding?

We provide guidance for systems deployment with robust project governance and executive sponsors. Our onboarding and implementation services are structured, user-friendly, and backed by experts experienced in complex environments. Every Nakisa client has a dedicated Account Manager and 24/7/365 support. We offer training materials, guides, and webinars to showcase best practices and address client pain points.

How frequently are Nakisa's updates and upgrades released to keep up with changing regulations and requirements?

Nakisa is committed to continuous integration, delivery, and deployment. We release two major updates annually and patches every 6-8 weeks—all without upgrade fees. Our goal is to bring industry innovations to all clients, ensuring they gain maximum benefit from our products.