Nakisa Lease Administration software has provided multinational Fortune 1000 companies with extensive end-to-end lessee accounting capabilities for years.

After working closely with our partners and clients, we realized there was a demand for both lessor and lessee accounting solutions, particularly for groups with multiple legal entities entering both internal and external lease arrangements.

Today, we are proud to announce that we are now offering Nakisa Lease Administration for Lessor Accounting. The solution includes several key features, including a multi-GAAP approach, critical lessor accounting terms, ERP integration, and disclosure abilities.

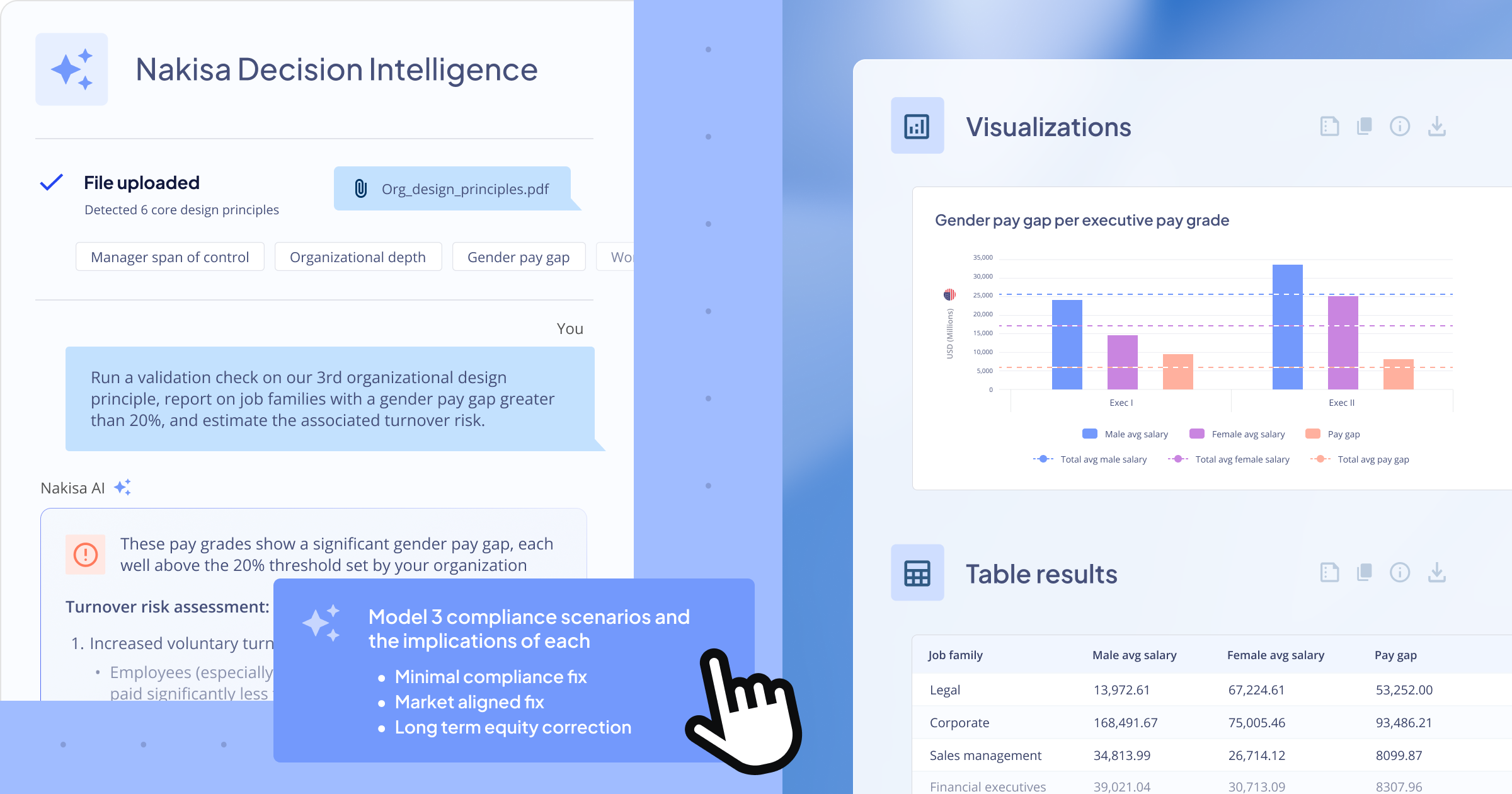

Multi-GAAP Approach

No matter which part of the world a subsidiary may be incorporated in, our lessor accounting solution allows the user to reflect lessor-driven accounting scenarios in conjunction with the most sophisticated regulatory requirements under both IFRS 16 and ASC 842. Managing a single solution in the cloud covers all possible lease scenarios for an entire group of companies. It is also designed to support regulatory compliance with GASB 87 under the Governmental Accounting Standards Board, which is the source of generally accepted accounting principles used by both state and local governments in the United States.

Key Lessor Accounting Terms

The Nakisa solution allows the user to trace the carrying amounts of a lease receivable, net lease investment, unguaranteed residual asset (IFRS 16 and ASC 842), sales profit and loss for sales-type leases (IFRS 16 and ASC 842), deferred revenue for direct finance leases (ASC 842), or deferred inflow of resources and even asset’s net book value (NBV) with follow-up depreciation (GASB 87 only) throughout the course of the lease lifetime.

Implicit contract rate is determined automatically by the software and is based on the inputs provided by the user. Once payments are scheduled, current gross book value (GBV) and accumulated depreciation along with the fair market value of the asset entered, the engine will determine the interest rate on its own and generate the schedules for the follow-up postings which are useful for analysis both for the customers and their auditors.

ERP Integration

With the solution’s integrated mode, users do not have to enter GBV and accumulated depreciation values themselves, as Nakisa Lease Administration will automatically read the balances from SAP’s Asset Accounting module and assure proper derecognition of the asset (under IFRS 16 and ASC 842) and its prospective depreciation (under GASB 87).

As with the lessee solution, the lessor engine will send inception, long- to short-term lease receivable reclassification, interest income accruals, payments (compliant with IFRS 16 and ASC 842), as well as lease revenue and asset depreciation postings (GASB 87 only) directly into an organization’s ERP environment.

Should a user prefer to apply the standalone mode, postings will be stored in Nakisa Lease Administration and may be uploaded into an ERP at a later stage, with the help of the Excel-based reports, available ad hoc.

Disclosure Capabilities

There are several complications in the overall process of accounting for lessor transactions. General regulatory requirements may take up a great amount of a user’s time and effort to provide the authorities with the necessary disclosures. Nakisa Lease Administration is able to do this for both lessee and lessor accounting requirements. Simply applying a few key filters within the software’s user interface will trigger an Excel-based report to be generated, capable of covering most business needs to meet statutory requirements for disclosures.

We are proud to introduce such a sophisticated calculation and accounting solution to our existing and prospective customers. We strive to continuously stay up-to-date with the most recent market needs and do our best to fulfill the most sophisticated expectations.

Providing a seamless, prescriptive path to the cloud, the Nakisa Lease Administration for Lessor Accounting solution includes:

- Powerful APIs to ensure cross-system data consistency

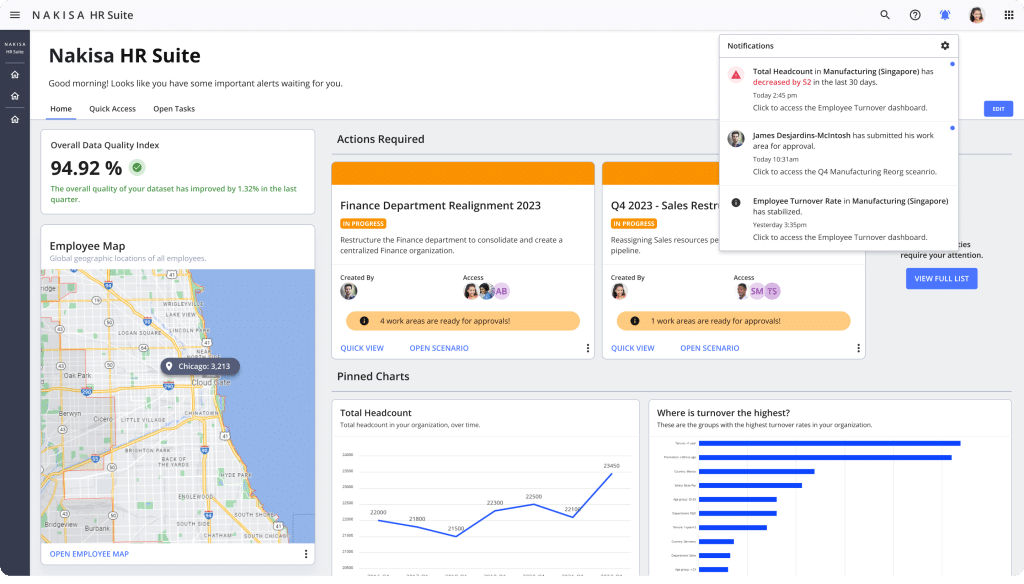

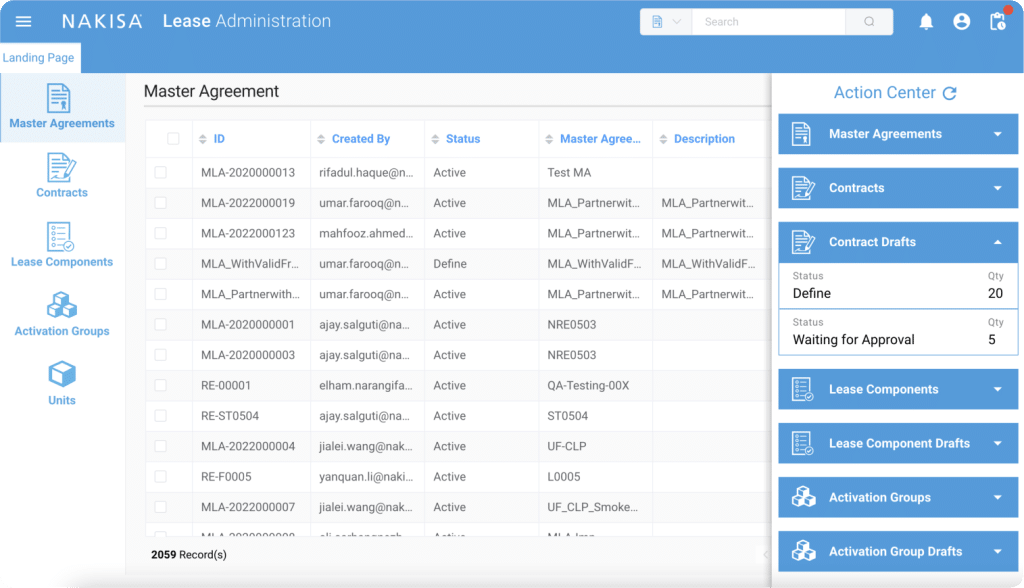

- Sophisticated revenue management with contract storage, automated reporting, advanced dashboard, and analytics

- Cutting-edge cloud technology for high availability, workload scalability, and load balancing

- Automated scheduled upgrades and robust audit and compliance tracking reduce risk and time spent on audit engagements

To learn more about our new lessor accounting solution, watch the Nakisa Lease Administration for Lessor Accounting release video below. Alternatively, request a demo to experience Nakisa's capabilities firsthand.