- What Is Percentage Rent?

- Advantages of Percentage Rent for Landlords and Tenants

- Key Considerations in Structuring Percentage Rent Agreements

- Calculating Percentage Rent: Methods and Breakpoints

- Best Practices for Successful Percentage Rent Management

- Percentage Rent Made Easy with Nakisa Real Estate

In this guide, we will dive into the concept of percentage rent (aka percentage lease), explore its advantages, discuss crucial factors to consider when structuring such agreements and provide insights into calculating and managing percentage rent using the Nakisa Real Estate (NRE) solution.

Whether you find yourself in the role of a landlord, responsible for leasing commercial retail spaces, or a tenant navigating the intricacies of lease arrangements, this guide is tailored to provide you with a comprehensive understanding. So, without further delay, let's jump right in and make percentage rent easier to navigate.

Key Takeaways

- Percentage rent benefits both parties: Percentage rent, or a percentage lease, creates a win-win scenario for landlords and tenants by linking rental income to gross sales, encouraging collaboration and shared success.

- Structure percentage rent agreements: Setting a fair percentage rate, understanding revenue calculations, tracking critical dates, and clarifying lease terms are essential for structuring percentage rent agreements.

- Calculate and manage percentage rent: Understanding natural and artificial breakpoints, along with the percentage rent formula, ensures successful percentage rent management, fostering trust between landlords and tenants.

What Is Percentage Rent?

In commercial real estate, percentage rent, or a percentage lease, is a tried-and-true concept. It serves as a strategic rental model that allows tenants to pay a percentage of their sales, typically gross sales, in addition to a base rent.

By connecting rental income to a percentage of the tenant's sales revenue, it motivates both parties to work together for a successful retail operation while minimizing risks.

Advantages of Percentage Rent for Landlords and Tenants

For landlords, a percentage lease offers a unique opportunity to share in the success of their tenants' businesses. Instead of relying solely on fixed monthly payments, landlords can benefit from the growth of their retail tenants.

By tying rental income to the tenant's sales revenue, landlords have a direct stake in the prosperity of the retail operation. This arrangement serves as a powerful incentive for landlords to actively support their tenants' businesses and provide the best possible environment for success.

On the other hand, tenants also reap significant benefits from the percentage lease model. One of the most appealing aspects for tenants is the reduced initial financial burden. With a lower base rent, tenants can allocate more resources to other essential aspects of their business, such as inventory, marketing, and customer experience. This financial relief can be precious for new companies or those navigating challenging economic conditions.

What is more, tenants only pay a percentage of their sales once they surpass a specific sales threshold. This means that when the business performs well and exceeds expectations, the rental costs increase in tandem with its success. This unique feature aligns the interests of both landlords and tenants as they mutually work towards achieving higher sales and profitability and reduce tenants’ risk during lean periods.

Key Considerations in Structuring Percentage Rent Agreements

Several essential factors come into play when setting up a percentage lease agreement. Primarily, the percentage rate plays a crucial role and should be fair to both parties.

It is essential to base this rate on industry standards and benchmarks to ensure a balanced and reasonable arrangement. Another critical consideration is how revenue will be calculated. Both landlords and tenants need a clear understanding of the process, including any exclusions or deductions that may apply.

Lease terms also have a significant impact on percentage rent agreements. Clearly outlining the lease length and renewal options is vital to align with the tenants' business goals and growth plans. Additionally, tenants may expect certain amenities or services from landlords, like maintenance, repairs, and utilities. It's crucial to negotiate and define these obligations clearly to maintain a positive and cooperative relationship between landlords and tenants. It’s also important for all parties to keep track of critical dates and deadlines in their agreements.

Calculate your percentage rent in just a few clicks using Nakisa Real Estate software! Read more about he workflow in our article.

Calculating Percentage Rent: Methods and Breakpoints

Calculating percentage rent involves specific terms outlined in the lease agreement, which can be grouped into two types: natural breakpoints and artificial breakpoints.

What Are Natural Breakpoints?

Natural breakpoints are determined by dividing the annual minimum base rent by the stated percentage rate. For instance, in a sporting goods shop, if the minimum base rent is $100,000, and the percentage rate is 5%, the natural breakpoint would be $2,000,000. Any gross sales above this threshold would require the tenant to pay the landlord 5% of the excess amount as a percentage of rent.

How to Calculate Percentage Rent with a Natural Breakpoint?

Percentage Rent = (Gross Sales - Natural Breakpoint) x Agreed-Upon Percentage

For example, if the tenant's gross sales are $3,000,000, and the natural breakpoint is $2,000,000 with an agreed-upon percentage rate of 5%, the calculation would be:

Percentage Rent = ($3,000,000 - $2,000,000) x 5% = $50,000

Therefore, the total rent the tenant must pay the landlord for the first year of the lease would be $150,000 ($100,000 Minimum Base Rent + $50,000 Percentage Rent).

Percentage Rent Calculator - Natural Breakpoints

What Are Artificial Breakpoints?

Artificial breakpoints are negotiated thresholds established through mutual agreement between the landlord and tenant. These breakpoints can favor one party over the other, as it really depends on the negotiating power of the party. Regardless of the type of breakpoint used, the formula remains the same.

How to Calculate Percentage Rent with an Artificial Breakpoint?

Percentage Rent = (Gross Sales - Artificial Breakpoint) x Agreed-Upon Percentage

Let's suppose that the negotiated artificial breakpoint between the landlord and our sporting goods shop owner is $1,500,000. With the same gross sales of 3,000,000 and an agreed-upon percentage rate of 5%, the calculation for the percentage rent would be ($3,000,000 - $1,500,000) x 5%) = $75,000.

Therefore, the total rent the sporting goods shop must pay the landlord for the first year of the lease would be $175,000 ($100,000 Minimum Base Rent + $75,000 Percentage Rent).

By understanding these methods and breakpoints, landlords and tenants can navigate percentage rent calculations effectively and ensure a fair and transparent rental agreement.

Percentage Rent Calculator - Artificial Breakpoints

Best Practices for Successful Percentage Rent Management

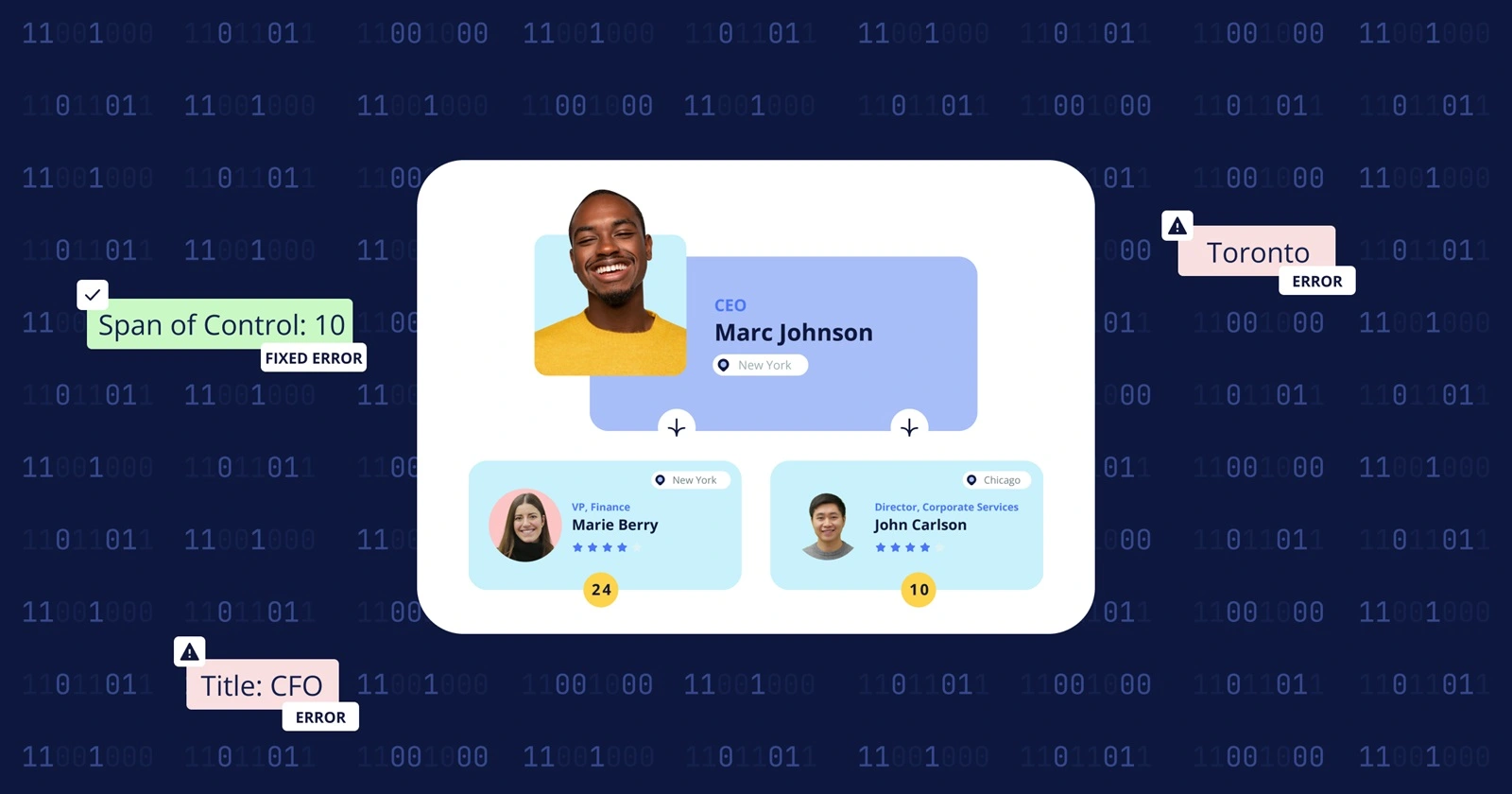

To ensure successful percentage rent management, landlords and tenants should follow best practices with clear communication and collaboration. Landlords must provide guidelines for reporting sales figures, and tenants should submit accurate sales data monthly for transparent calculations.

Additionally, keeping thorough records and documentation related to the percentage rent agreement is crucial. This includes tracking sales data, retaining receipts, and noting adjustments or exclusions. Regular reviews and audits help identify discrepancies and ensure compliance with the agreement's terms, fostering a fair and trusting relationship between landlords and tenants.

However, managing these intricate processes can become tedious and cumbersome over time, often leading to errors or misunderstandings. This is where a cutting-edge real estate management solution comes into play. It streamlines the entire percentage rent management process by automating data collection, calculations, and record-keeping.

Percentage Rent Made Easy with Nakisa Real Estate

Calculating percentage-based rent in Nakisa Real Estate is a breeze, thanks to its user-friendly features. With just a few clicks, users can add specific conditions such as dates, exclusions, and rules to tailor the system according to their needs.

Additionally, our solution allows users to create various rules, precisely defining the type of percentage rent and the applicable categories. Internal and external categories can be easily configured and excluded based on specific requirements. Users also have the flexibility to upload sales data manually or using our convenient Excel template.

Lastly, Nakisa Real Estate lets users define vital details like adjustment frequency, payment frequency, expense categories, Common area maintenance (CAM), minimum and maximum values, and breakeven point type.

Are you interested in learning more about our real estate solution? Feel free to check out our comprehensive buyers guide and real estate trends blog. You can also Book a demo today with Nakisa Real Estate for a complete understanding of how our solution can simplify your real estate needs.