Understanding lease liability calculation

On its face, calculating lease liability comes down to a fairly simple formula: take the present value of lease rentals plus any expected payments at the end of the lease. Easy, right?

In truth, there are several instances and events that can cause a lease liability to change. Identifying and understanding the effect of these changes will greatly help you assess the amount of effort required to account for these leases, under the new standards.

Payment types impacting lease liabilities

There are five major payment types that need to be included in lease liabilities under the new standards:

Guaranteed residual value

Certain lease contracts can contain a Guaranteed Residual Value (GRV) that needs to be accounted for. A GRV requires the lessee to guarantee the value of the underlying asset when it is returned to the lessor. When lessees provide such guarantees, they should include the amount they expect to pay under the guarantee in the lease payment. However, this GRV amount can change throughout the lease. When that happens, the lessee uses an unchanged discount rate to remeasure the lease liability.

Purchase option

On the commencement date, a lessee should determine how certain they are to exercise an option to purchase the underlying asset. The lessee should include the exercise price of the purchase option in the lease payments if they are reasonably certain they will utilize the purchase option. However, if a lessee changes its assessment of how certain it is to exercise the purchase option, it should remeasure the lease liability and discount the new lease payments with the appropriate rate (which may or may not be revised).

Termination penalties

On the commencement date, a lessee should consider all relevant information to determine how certain they are to exercise an option to terminate the lease early. The lessee should include the early termination in the lease term unless it is reasonably certain not to terminate the lease early. The termination penalty should be included in the measurement of the lease liability. If a lessee changes its assessment of how certain it is not to terminate the lease early, it should remeasure the lease liability and discount the new lease payments with the appropriate rate (which, again, may or may not be revised).

Variable lease payments

Variable lease payments are those that depend on an index or rate, such as payments linked to a benchmark interest rate (e.g. LIBOR), consumer price index (CPI), or payments that are adjusted to reflect changes in market rental rates. To make things even more complex, the reporting for CPI variable payments differs between IFRS 16 and ASC 842. IFRS 16 states CPI payments are to be capitalized which is not the case for AC 842. Furthermore, variable payments other than those that depend on an index or benchmark rate are excluded from the lease liability.

Fixed payments

Lessees should include fixed lease payments in the lease liability. The main facet in identifying a fixed payment is that these payments are– in substance – unavoidable. The main types include:

- Payments must be made if an event occurs (including a modification) in which the likelihood of such an event was not likely at the commencement of the lease.

- Payments that generate an (or multiple) escalator either stipulated by the lease contract or from a reassessment

These incidents may not be straightforward to calculate, especially when multiple unexpected events or reassessments take place on the same lease. Determining what payments are included in your lease in addition to recalculating and reporting for the new ROU asset and Lease Liability can be complicated and time-consuming.

Solutions to simplify the complexity of identifying lease payments

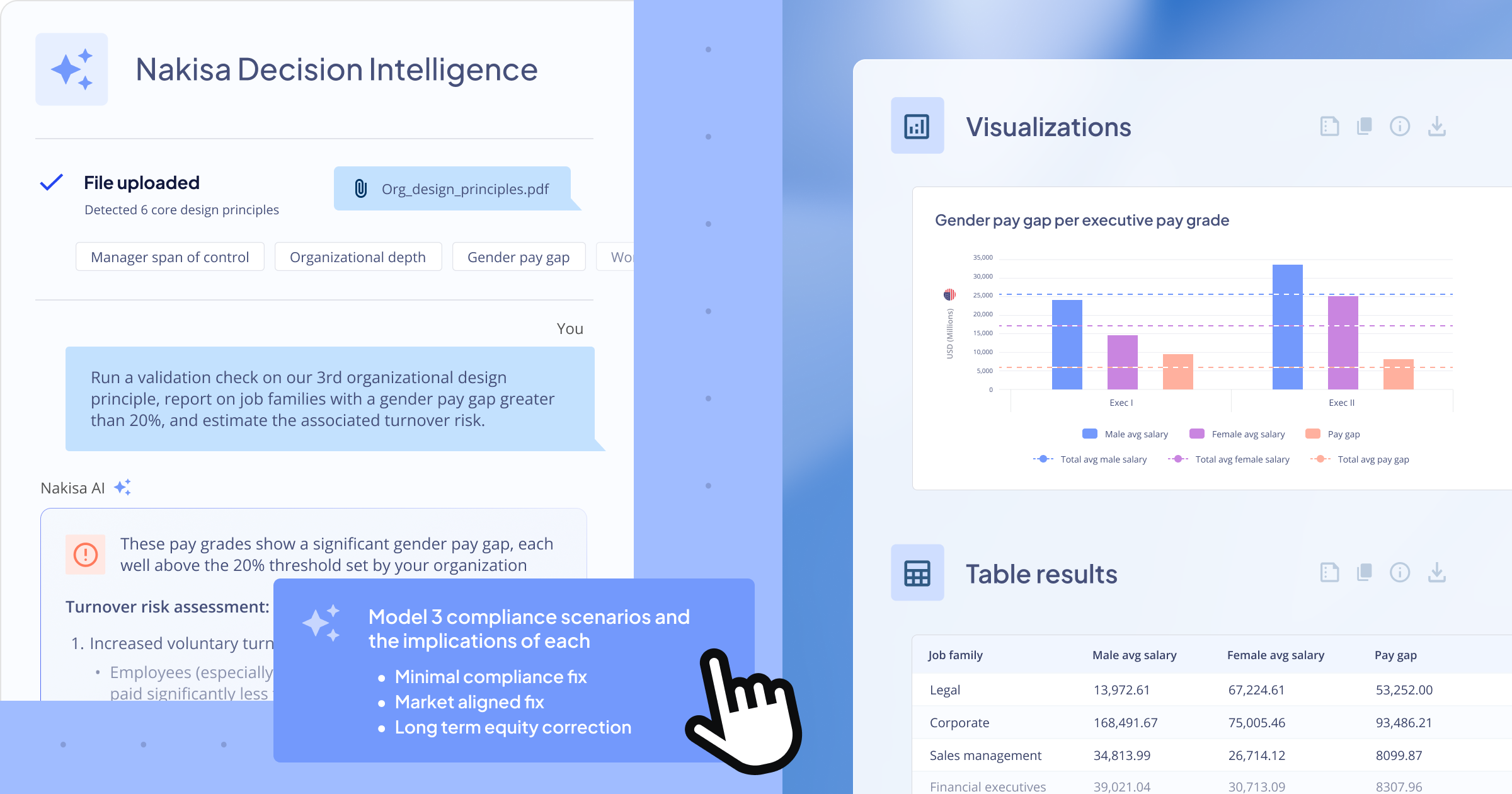

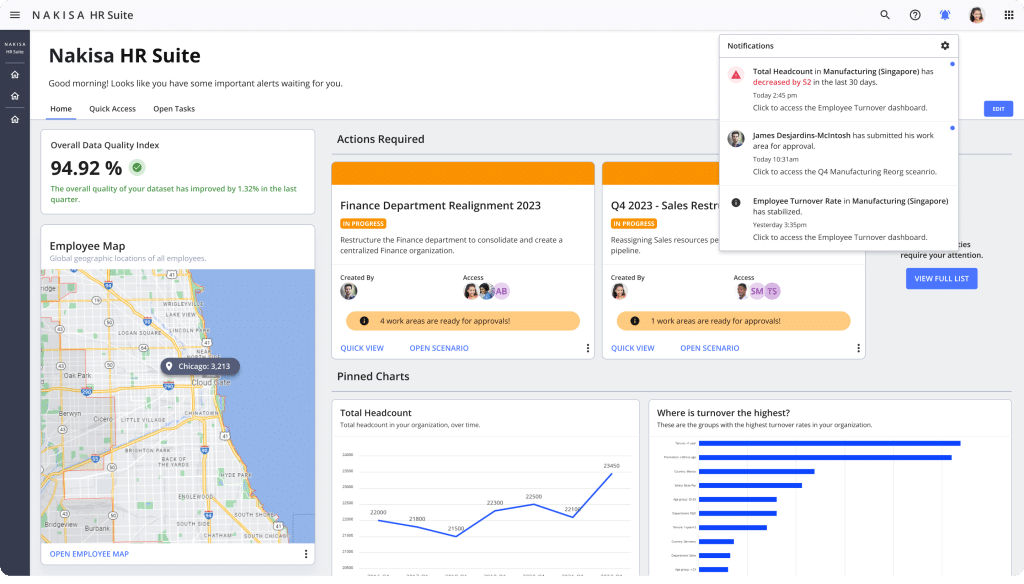

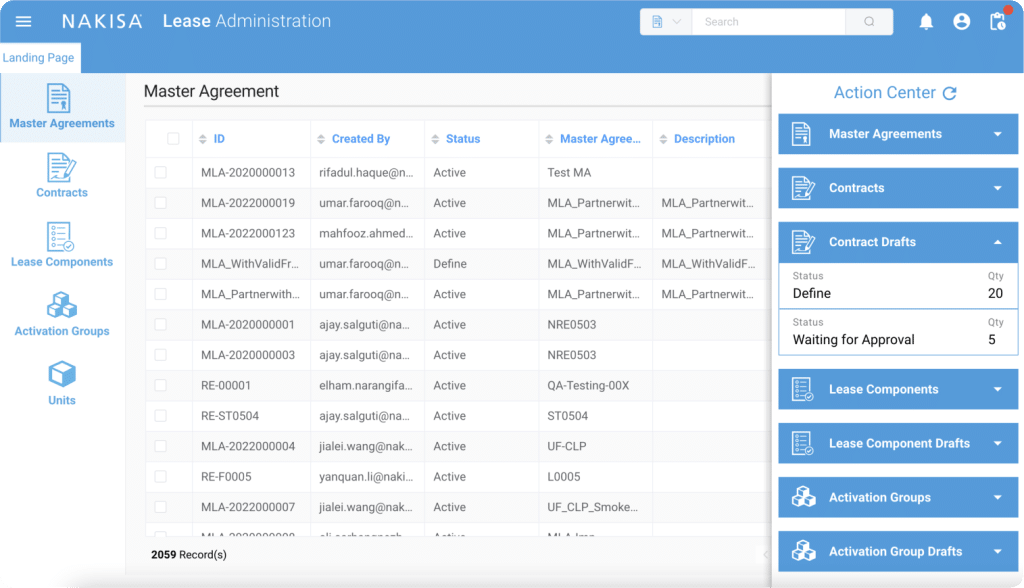

Luckily, there are tools out there that perform the initial determination of ROU assets and lease liabilities as well as any subsequent modifications and measurements. Nakisa Lease Administration, for instance, provides end-to-end lease accounting support so you can spend less time determining lease liabilities and more time focusing on what matters. Learn more about how Nakisa Lease Administration can help you with IFRS 16 and ASC 842 compliance.

Identifying lease payments to include in lease liabilities is no doubt a complicated process. Only with the right understanding, process, and tools, can organizations have a better handle on their lease accounting strategies. Explore more about Nakisa Lease Administration or request a demo tailored to your business requirements.

Prepare for a seamless year-end audit with Nakisa! Read our guide where industry experts share their knowledge and best practices from Fortune 1000 companies.