“Time is on my side, yes it is.” It’s a great sentiment. But the Rolling Stones obviously weren’t writing about the upcoming IFRS 16 and ASC 842 lease accounting standards when they wrote their classic song. With only a little more than six months until the standards take effect, time is certainly not on the side of companies who still haven’t examined how the rules will impact their financial statements.

But, let’s put the time constraints aside for a second. As organizations examine their current leasing setups and compare them to the new guidelines, many are seeing a clearer picture of how complicated the shift will be. There are a few reasons for this complexity.

There’s a lot of data to gather—and it’s not all in one place

Anyone who deals with leases on a regular basis knows that proper tracking requires a lot of information. The new standards add even more data to that equation.

Gathering, collating, and analyzing all the necessary data is a costly and time-consuming task. And organizations who’ve been using legacy lease administration software are discovering that the complexity of event management under the new standards makes it nearly impossible to run proper lease analysis.

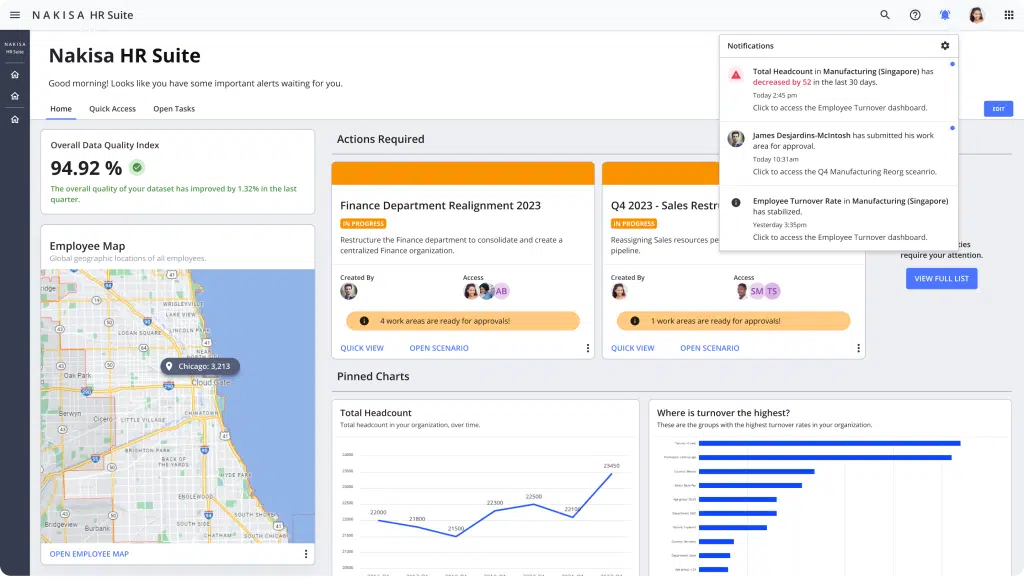

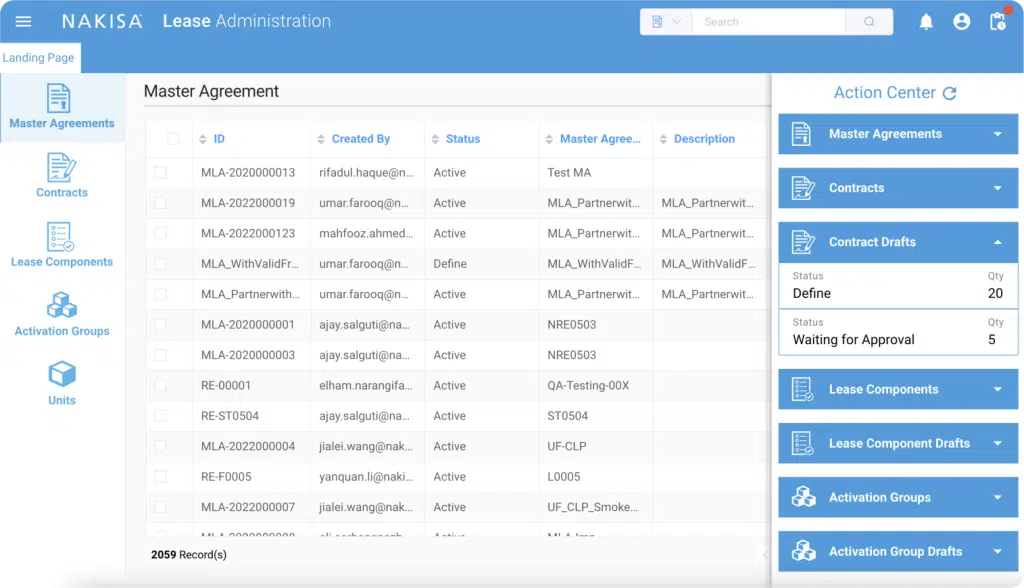

We’ve heard from many organizations that manage global lease portfolios who are looking for systems that can centralize all their data and properly analyze it at scale.

Centralizing your data is only half the battle

The new lease accounting standards clearly outline how organizations must recognize, measure, present, and disclose leases.

What’s that mean for you? Simply centralizing contract data and handling the initial recognition of right-of-use asset and lease liability is not the end of your work. Not by a long shot. Subsequent measurement is also required. The new standards require organizations to amortize the right-of-use asset and lease liability, account for lease modifications, and provide quantitative note disclosures.

But wait. That’s not all.

Depending on whether your organization is adopting the full retrospective method under IFRS 16 or the modified retrospective method under ASC 842 without the transition relief, you’ll need to conduct parallel reporting and you’ll need to change comparative numbers. That means if you’re a lessee under the new standards, you would need to know the overall liability--and ROU asset--balance you currently have under your existing leases. You’d also need to determine what the balance would be when you finally do assess and classify theses leases under the new standard.

Aggregating data is no simple task

If you’re trying to calculate lease liabilities and ROU assets by way of discounted cash flows without specialized software, you probably know how difficult that process can be. Add to that trying to aggregate leased assets with different starting dates and your task becomes nearly impossible.

The new standards provide guidance on how to measure and record ROU assets and lease liabilities at the start of a lease. They also outline subsequent measurements, modifications, and reassessments. But ensuring your data is uniform is yet another added complexity.

Technology changes the game

Shifting to the new lease accounting guidelines will always require a lot of work, but it doesn’t have to be overwhelming. That’s where technology comes in.

The best technology solutions simplify the lease accounting process from inception to termination. Instead of trying to adapt your legacy systems to fit the new standards, make sure you use a system specifically designed to support compliance by generating the necessary accounting calculations required under IFRS 16 and ASC 842. These systems should streamline data collection, tracking, and validation to ensure access to accurate data across your organization.

If your organization has a considerable lease portfolio with data spread out both geographically and departmentally, you may feel overwhelmed by the complexity of the shift to the new standards. And, the ticking clock for compliance creates added pressure.

Finding the right comprehensive software solution will help. If you’re still evaluating lease accounting solutions, make sure you consider systems that will help streamline the entire compliance process – from initial recognition to subsequent measurement and then re-measurement of lease liability (and ROU asset) under the new standards.

Time may not be on your side, but with the right solution, you can make the lease accounting process work more smoothly for your organization.